The data needed to make informed investment decisions is often fragmented and hard to find, with availability varying hugely from market to market. And – while investment strategy is entirely independent of proxy voting – the two can benefit from much of the same information.

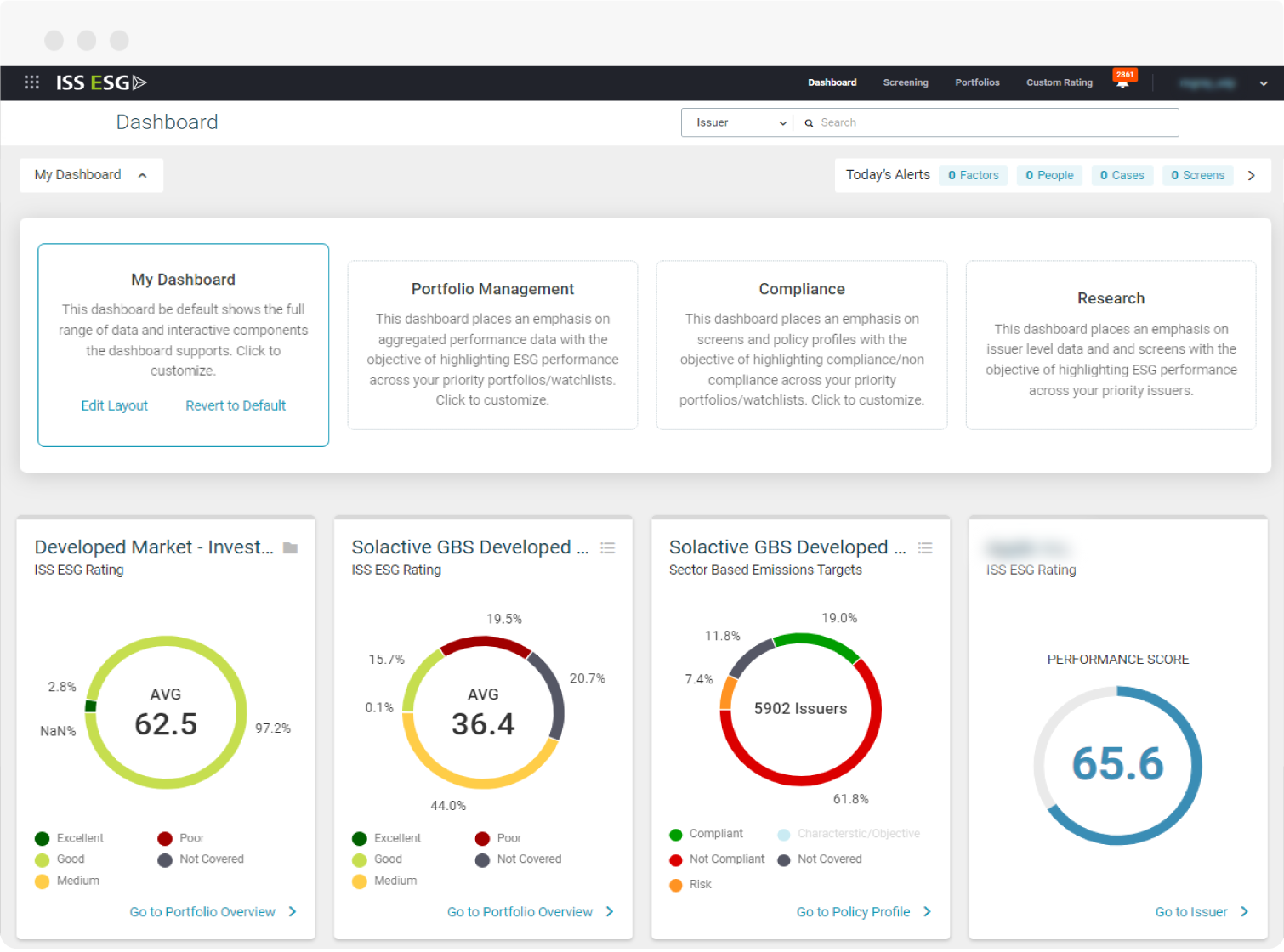

ISS DataDesk can enhance investment decision-making, ESG data integration, and portfolio reporting by delivering robust data spanning over 100,000 issuers through an advanced screening and analytics platform.

THE PLATFORM ALLOWS YOU TO:

- Complement traditional research with information often overlooked by fundamental analytics, from robust ESG data to expert insights into corporate performance, board practices, director characteristics and shareholder rights

- Access a global, integrated view of your portfolios’ performance across both ESG and corporate governance, enabling you to analyze trends, assess progress, and identify areas for improvement

- Navigate seamlessly between portfolios, screening tools, alerts, issuers, individual directors, and beyond, accessing the information you need in just a few clicks

- Customize your workflows to prioritize the data and insights most relevant to your investment strategy, and monitor compliance with specific policy criteria defined by you

AVAILABLE ON DATADESK

RESPONSIBLE INVESTMENT CONTENT

GOVERNANCE CONTENT

FINANCIAL CONTENT

Includes basic Issuer Financials, Share Price and Dividend Performance, and Valuation Measures