ISS ESG / RATINGS & RANKINGS

GOVERNANCE QUALITYSCORE

Identify corporate governance risk within your portfolio.

Corporate governance risk can expose a company and its stakeholders to legal, regulatory, and reputational risks, yet many investors lack the information needed

to conduct a holistic risk assessment.

Reduce time spent combing through filings by taking advantage of ISS ESG’s expertise in capturing and providing critical and easily digestible governance data to help you more efficiently analyze results.

Use Governance QualityScore to help:

Enhance your Stock

Selection Process

Analyze

Portfolio Risk

Screen for

Engagements

Incorporate Raw Factor Data and Scores into Quant Models

Support Policy

Development

Inform Proxy Voting

Decisions

Governance QualityScore is a data-driven scoring and screening solution designed to enable quality reviews of corporate governance across four key areas:

- Board Structure

- Compensation

- Shareholder Rights

- Audit & Risk Oversight

View recent updates to the Governance QualityScore Methodology

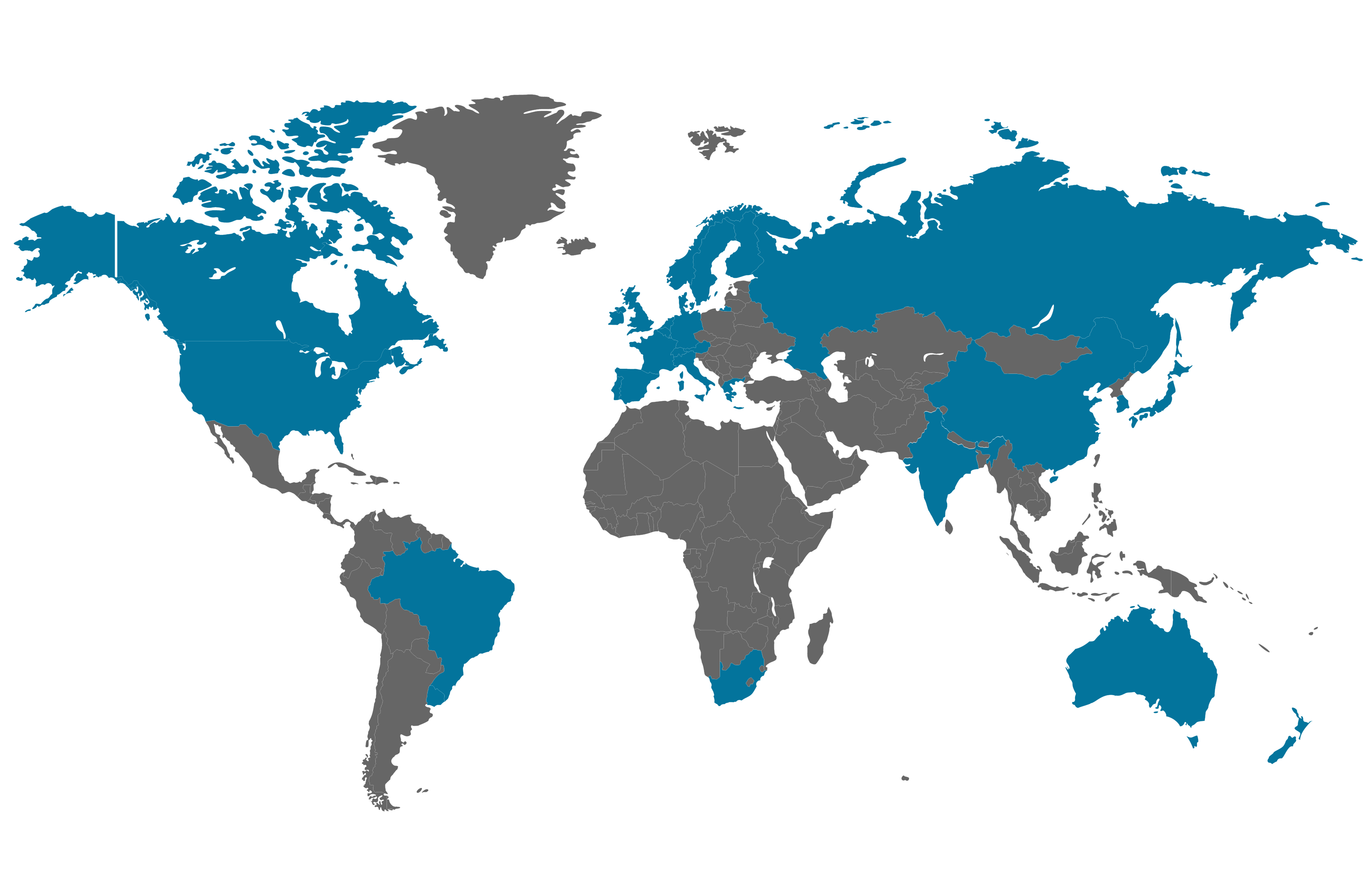

GLOBAL COVERAGE

Governance QualityScore provides global coverage of approximately 7,300 issuers in 30 markets.

7,300

ISSUERS

Data as of January 2023. All figures are approximate.

Source: ISS ESG Research

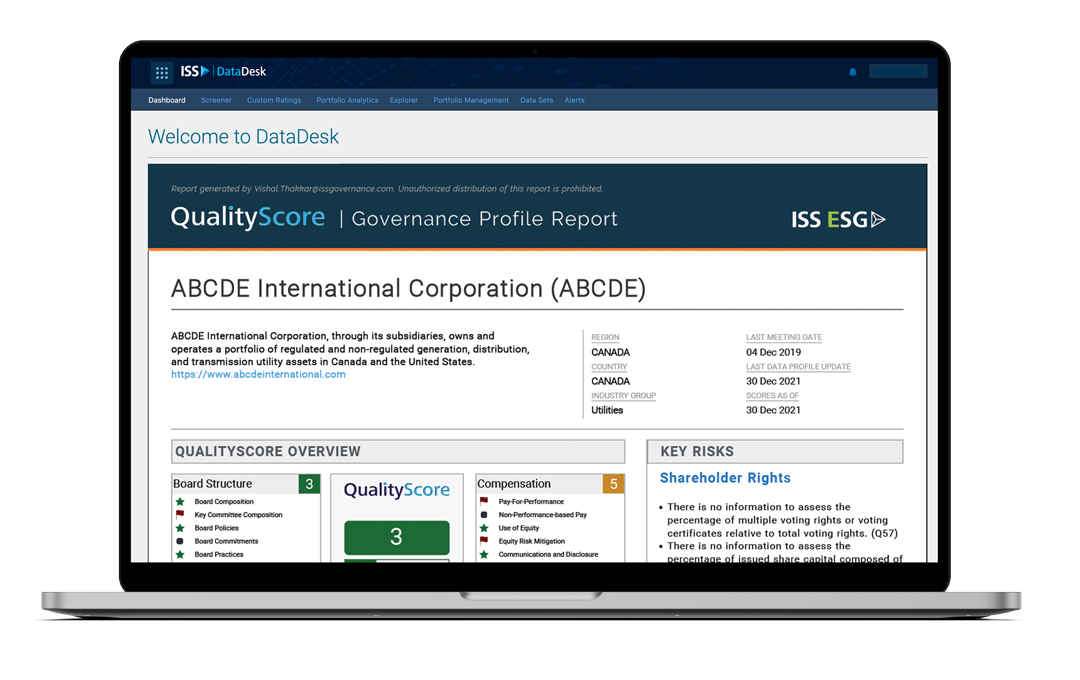

Access Actionable Insights on DataDesk

Delivered through ISS ESG’s proprietary DataDesk platform, and data feeds, investors can easily ingest Governance QualityScore into their own internal processes to leverage scores within internal workflow platforms.

Distinct Methodology for Assessing Companies’ Corporate Governance Risk

Governance QualityScore uses a decile-based score that indicates a company’s governance risk, where 1 is low risk and 10 is high risk.

The methodology focuses on the qualitative aspects of governance, including global governance standards and alignment with ISS voting policy in each region.

ISS ESG’s annual methodology review ensures that the methodology remains aligned with the ISS benchmark policies as they adapt to reflect developments in regulatory and market practice.

Experience Secure And Reliable Data Delivery

Clients can access Governance QualityScore data via the following delivery methods:

Use ISS ESG’s proprietary DataDesk platform to gain insight into a company’s corporate governance structures, quick drill-downs into particular areas of concern, and deep dives into underlying governance data.

Easily ingest decile rankings, individual factors, and company identifiers through your own internal processes and highlight scores within internal workflow platforms.

Link your internal platform to the Governance QualityScore API to directly access Governance QualityScore Profiles and drill into the key risks, to easily bring governance insight into investment decisions and proxy voting processes.

Governance QualityScore data can also be accessed through the following partners and platforms:

- Aladdin

- Alphasense*

- Bloomberg Terminal*

- Bloomberg Data Management Services

- Calibre

- Crux Informatics

- FactSet Workstation*

- FactSet Workstation Research*

- Open: Factset

- Axioma

- Rimes Managed Data Services

- Snowflake

*Limited offering

DEEP DIVE INTO GOVERNANCE QUALITYSCORE

Review, verify, and provide feedback on the data used to determine the Governance QualityScore.

Elevate Your Diversity, Equity, and Inclusion Strategy with

ISS ESG’s Equal Employment Opportunity (EEO-1) Data

Dive deeper into a company’s workforce diversity disclosure practices by combining ISS ESG’s Governance QualityScore factors on diversity, equity, and inclusion (DEI) with detailed information and time series provided

by ISS ESG’s EEO-1 Data.

CONTACT US TO LEARN MORE ABOUT: ISS ESG’s Equal Employment Opportunity (EEO-1) Data ›

GOVERNANCE QUALITYSCORE THOUGHT LEADERSHIP