ISS ESG / RATINGS & RANKINGS

WATER RISK RATING

Access a holistic assessment of companies’ exposure to freshwater-related risks.

ISS ESG’s Water Risk Rating helps you mitigate freshwater-related risks across your investment portfolio by identifying industries and companies that depend on or greatly impact freshwater resources.

The ISS ESG Water Risk Rating enables investors to address water risks in their portfolios by providing a holistic and granular assessment of a company’s exposure to freshwater-related risk comprised of 11 distinct data points per company.

DID YOU KNOW THAT:

While water covers approximately 70 percent of our planet’s surface, only 0.5 percent is in the form of freshwater that is readily available in lakes and river systems.

Source: Water Facts – Worldwide Water Supply, Bureau of Reclamation California-Great Basin, (November 4, 2020)

More than two-thirds of the rated companies have a high or medium exposure to freshwater-related risks which are unaddressed or inadequately managed.

As of March 2022

Distinct Methodology for Assessing Companies’ Freshwater Risk Exposure and Management

The Water Risk Rating provides an aggregated score of a company’s overall management of freshwater-related risks based on these complimentary pillars.

WATER RISK EXPOSURE CLASSIFICATION

WATER RISK

MANAGEMENT

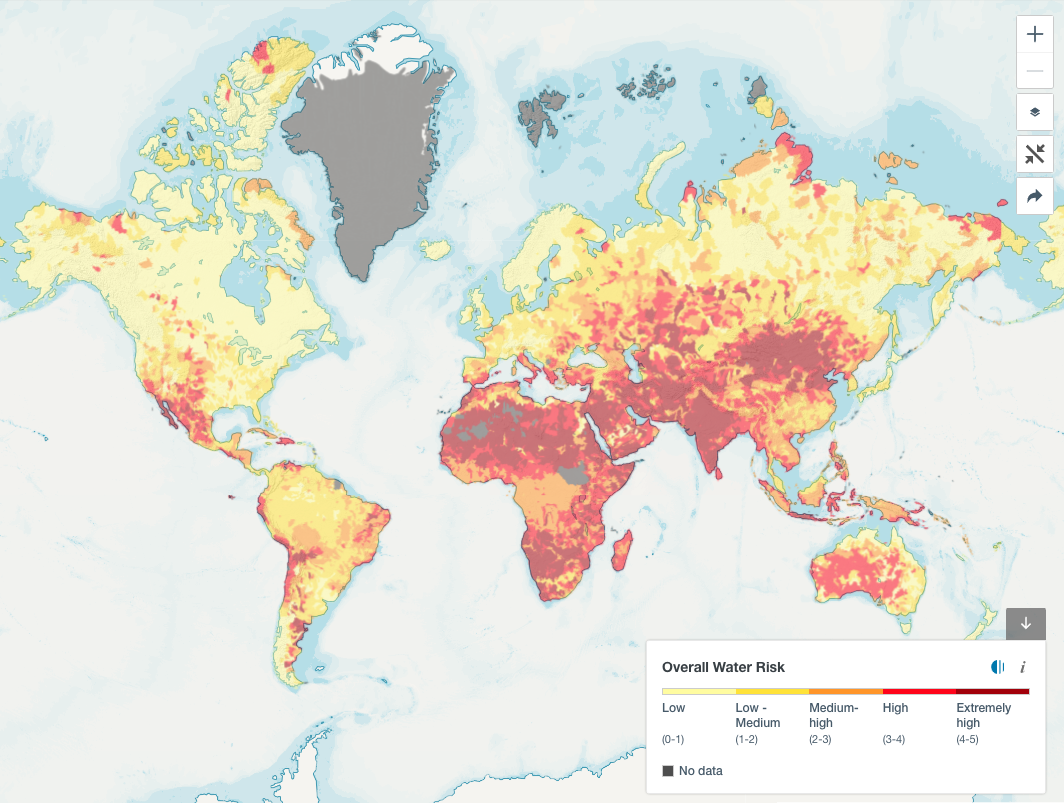

Determine Your Portfolio’s Water-Related Physical Risk Exposure

Assess the water-related physical risk exposure and access information on company-specific geo-based water risks, measured by pairing information on a company’s geographical footprint with data on baseline water stress from the World Resource Institute Aqueduct Water Risk Atlas.

CONTRIBUTE TO THE UN SUSTAINABLE DEVELOPMENT GOAL 6:

Clean Water & Sanitation

Flag companies based on the overall impact of their product and services portfolio on the achievement of the sustainability objective “Conserving Water”, which is derived from ISS ESG’s SDG Solutions Assessment*.

*The SDG Solutions Assessment measures the positive and negative sustainability impacts of companies’ product portfolios, following a thematic approach using the United Nations’ Sustainable Development Goals as a reference framework.

COVERAGE

Approximately

issuers globally

Data as of January 2023.

All figures are approximate.

Powered by ISS ESG’s Corporate Rating, Norm-Based Research, SDG Solutions Assessement, as well as data on baseline water stress from the WRI Aqueduct Water Risk Atlas.

RISK ASSESSMENT

Assess companies’ overall freshwater-related risks

BENCHMARKING

Identify best practices and compare companies within the same industry

PRODUCT DEVELOPMENT

Build freshwater-focused portfolios, funds & indices