ISS ESG / SCREENING & CONTROVERSIES

SCREENING & CONTROVERSIES

Screen and research companies based on criteria of importance to you.

Research, analyze, and screen companies for use in risk management and portfolio construction.

Our ESG experts bring extensive expertise across a full range of ESG issues, having worked with leading asset owners and asset managers to design tailored solutions to integrate sustainable and responsible investing into their approach and inform investment decisions.

CHOOSE A SCREENING SOLUTION

Our ESG experts provide on-going monitoring and research on company practices, assessing information through numerous sources and following through with expert analysis and consultation.

Analysts gather information through the media and other public sources, conduct interviews with stakeholders, and collect information on company policies and practices. Extensive company and stakeholder dialogue, coupled with strict verification, ensures objectivity and exhaustiveness of the research.

MODERN SLAVERY SCORECARD

Play a pivotal role in tackling the pressing issue of modern slavery through monitoring, reporting and engagement. Use Modern Slavery Scorecard to identify, evaluate and act on modern slavery risks and their impact on investments.

NORM-BASED RESEARCH

Assesses companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption set out in the UN Global Compact and OECD Guidelines.

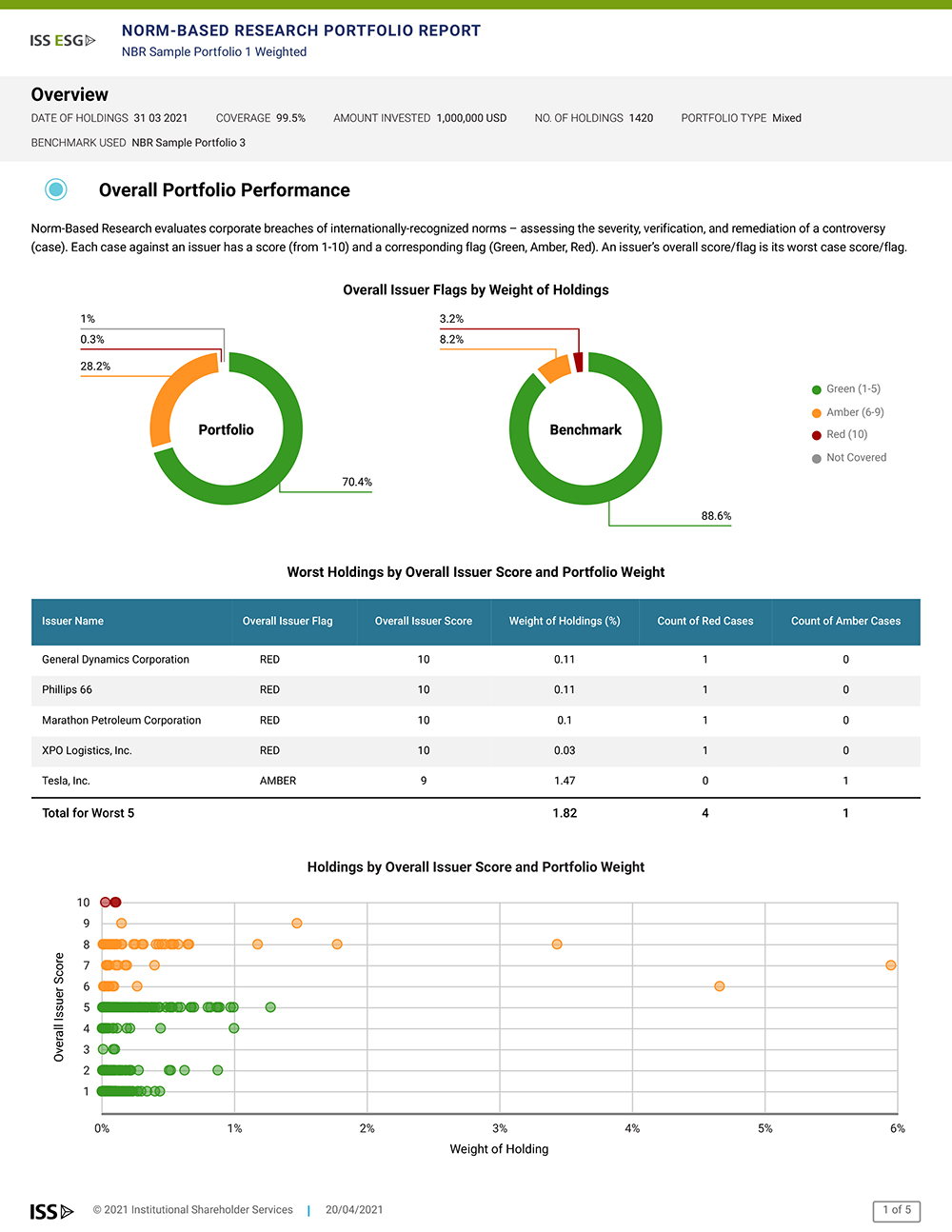

The Norm-Based Research Portfolio Analytics Report evaluates a user-defined portfolio of issuers, assessing corporate alignment with global norms on environmental protection, human rights, labor standards, and anti-corruption; and comparing performance to a chosen benchmark.

KEY BENEFITS

- Evaluation of a custom portfolio

- Performance comparison versus a chosen benchmark

- Identification of issuers with the worst signals and largest number of controversies

- In-depth analysis using ISS ESG’s Norm-Based Research methodology

- Assessment by UN Global Compact Pillars

- Informative and engaging visuals

ESG NEWSROOM

Identify reputational risks by monitoring ESG news categorized across more than 100 ESG themes related to human rights, labor rights, and environmental and business malpractice. Complement Norm-Based Research with ESG Newsroom to identify potential corporate ESG controversies.

CONTROVERSIAL WEAPONS RESEARCH

Assesses companies’ involvement in banned or controversial weapons, including cluster munitions, anti-personnel mines, depleted uranium, nuclear weapons, and biological and chemical weapons.

SECTOR-BASED SCREENING

Assesses companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

Islamic Finance, Palm Oil, Hazardous Substances, Violent Video Games and Euthanasia

ENERGY & EXTRACTIVES SCREENING

Assesses companies’ involvement in the extraction of fossil fuels, and the generation of power from fossil fuels, nuclear and renewable sources.

GLOBAL SANCTIONS SCREENING

Assesses companies with ties to countries of concern and/or countries under UN, EU or U.S. sanctions.

COUNTRY SCREENING

Screening countries’ exposure to various controversies, including alignment with international norms and conventions.

FUND SCREENING

Allows for large scale monitoring of funds on the basis of their underlying holdings and screening of multi-level fund holdings, which is fully extendable to underlying fund-in-fund structures.

Data and analytics are delivered via ISS DataDesk, as well as through data feeds and reports that provide contextualized information to help investors understand and address ESG risks.

Our screening and research solutions are an integral resource for institutional shareholders to screen, monitor, and analyze responsible investment performance when considering whether to undertake more active engagement and communication.

Trust Screening & Controversies to help you manage ESG risks & seize investment opportunities.