Can peer selection offer insights into the board’s thinking and strategic direction for the company? And what else can it tell us about emerging sources of competition for companies?

These are questions that intelligent consumers of company-disclosed compensation data are trying to answer by analyzing peer groups in more detail.

Compensation Committees spend considerable time and effort constructing the “just right” peer group for their company. They often start by selecting peer companies that are direct competitors for products and services, capital, and talent, and then occasionally select a few aspirational peers which may be larger in size and scope than the company. However, ISS’ experience suggests that committees also select peers in industries that they are considering for business expansion or other peers that are candidates for M&A. The next question becomes, is there a way to identify these companies in a peer group?

In our recent ExecComp Insights article, we introduced a rubric to evaluate a company’s selected peers based on their relative size and the strength of the peer network – how often companies are selecting each other and their closely-related peers. From this peer connection data, we build a prioritized list of companies that are closest aligned to the target based on connections to other companies – the “wisdom of the crowd,” as it relies on the judgment of many boards and their peer selections to develop a perspective on any one company.

Each company’s actual proxy-disclosed peer group is compared to its prioritized “wisdom of the crowd” peer network, as well as its relative size criteria to categorize each company peer choice into one of six categories. Those categories are arranged like this:

| Connection Strength | ||||

| Low | High | |||

| Size (as a multiple of the subject company) |

Small (<0.4x) |

Bad Fit (Small) |

Peers of Necessity | |

| Comparable (0.4x – 2.5x) |

New Wisdom | Conventional Wisdom | ||

| Large (>2.5x) |

Bad Fit (Large) |

Aspirational | ||

For a more detailed explanation of the methodology as well as the definition of each of these classifications please refer to the recent ExecComp Insights article.

Conventional Wisdom peers are those that fall within the optimum size range and have high connection strengths – this is where we expect companies to select the majority of their peers. And, in fact, that’s what the numbers show: on average, almost 70 percent of peers chosen by S&P 500 companies fit into the Conventional Wisdom peers. And we recognize that some companies cannot find enough peers in their industry of a similar size – and that they sometimes have to look for companies significantly larger or smaller to fill their peer groups. Those are the Peers of Necessity and Aspirational Peers in the rubric.

New Wisdom peers: Small in number, but concentrated

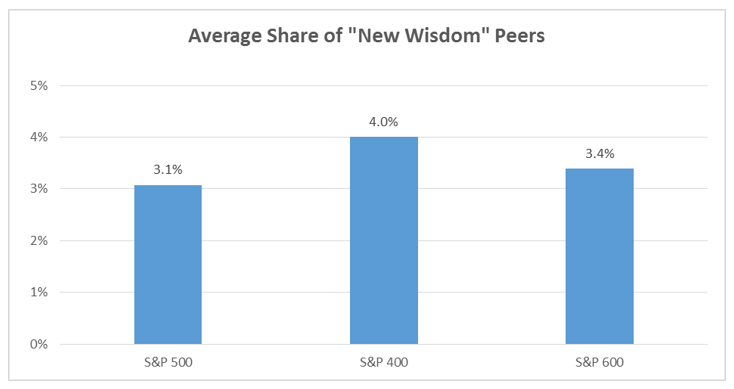

Sometimes companies select peers that seem to fit appropriate size constraints, but not from a peer connection strength perspective – these are the New Wisdom peers. While small in number, these peers may contain some of the most interesting information for investors. New Wisdom Peers, on average, represent three to four percent of all company-selected peers when we examine the peer constituents of the S&P 500, S&P 400, and S&P 600 indices. But with the average peer group size of around 15 companies, on average that’s one company in each peer group that can be potentially used to gain some insights into the board’s strategy.

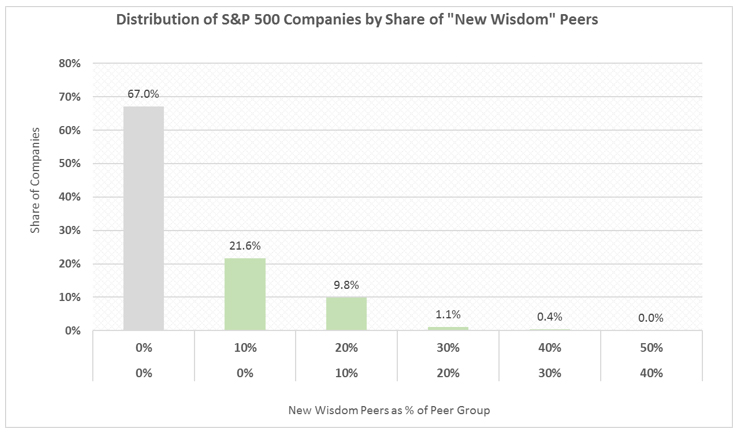

Taking a closer look at the breakdown of New Wisdom Peers for S&P 500 companies, we observe that two thirds of S&P 500 companies don’t have any peers that we classify as New Wisdom Peers; however, the remaining third (33 percent) of companies have one or more peers classified as New Wisdom.

These one third of S&P 500 companies may be of most interest as they are selecting a higher percentage of peer companies that could shed some light on the future direction of the company. Similar trends persist for the S&P 400 and S&P 600 indices where 40 percent and 34 percent of companies, respectively, are choosing New Wisdom Peers.

What New Wisdom peers can tell us

Why are boards selecting these seemingly poorly-connected companies as peers? In some cases, the answers seem clear: a paucity of comparable companies of an appropriate size that make the company go outside its industry, and outside the “Wisdom of the Crowd,” to fill its peer group. Companies such as Bank of America Corporation and The Coca-Cola Company, both among the twenty companies with the highest proportion of New Wisdom peers, seem to fit this model.

But there are other, much smaller companies in that top twenty list that don’t have the same difficulty in finding industry peers. These are the companies that investors might focus on; these peer groups may contain information that provides a new window into company strategy and insights into the board’s thought process. But perhaps even more importantly, these New Wisdom peers may begin to reveal emerging sources of competition for revenue, talent, capital, supplier and partner resources, and more for companies. And not just for the companies selecting them – but also for companies that are selected as a New Wisdom peer by another company.

In summary, a careful analysis of peers that companies are selecting and disclosing in their proxy statements can offer a window into the board’s thought process and possible future direction of the company. We recently formulated a scoring model that leverages all peer groups captured in ISS’ database of publicly-traded U.S. companies to help in classifying peers into peer-fit categories, which can be used as a mechanism to screen for unexpected peer company selections and potentially gain insight into the strategic direction of the subject company.

Contact ISS Analytics to learn more about the scoring model and to understand how ISS-Analytics can help you bring unique and differentiated governance data into your research and investment decision-making processes.