SHAREHOLDER RIGHTS DIRECTIVE II

RESOURCE CENTER

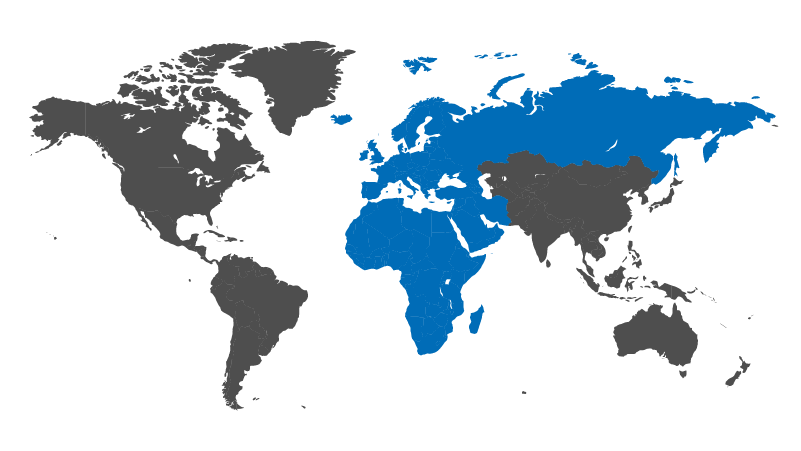

In response to the 2008 global financial crisis, the European Commission proposed in April 2014 a revision of the original 2007 Shareholder Rights Directive in 2014. The revised Shareholder Rights Directive (“SRD II”), which took effect in June 2017, seeks to reinforce effective and long-term shareholder engagement and monitoring of company performance. Both elements were lacking during the crisis when many companies took on excessive risks in the pursuit of short-term returns. EU member states were called upon to amend their laws to comply with SRD II by June 10, 2019. As of Feb. 26, 2020, 20 EU member states had implemented SRD II into their local legislations.

KEY NEW REQUIREMENTS OF SRD II

The directive is subdivided into three main chapters.

VOTING CHAIN

- Companies should have access to the identity of shareholders without delay.

- Transmission of information that enables the exercise of shareholder rights should be made in electronic and machine-readable formats.

- Intermediaries are required to facilitate the exercise of shareholder rights including confirmation that shareholder votes were recorded and counted accurately.

TRANSPARENCY

- Engagement policies of institutional investors and asset managers.

- How shareholder engagement is integrated into investment strategy including how voting rights were exercised.

- Institutional investors’ investment strategies and arrangement with asset managers.

- Proxy advisors shall disclose a reference to the code of conduct they apply and report on the application of that code.

REMUNERATION & RPTs

- Shareholders will have the right to express their views on executive pay.

- Separate votes on the remuneration report and remuneration policy.

- The European Commission will provide non-binding guidance about the presentation of the remuneration report.

- Rules on transparency and approval process of related-party transactions.