ISS ESG | REGULATORY SOLUTIONS

EU TAXONOMY ALIGNMENT SOLUTION

Quantify the share of your taxonomy-aligned investments.

Are you prepared?

The European Union’s Taxonomy brings new mandatory reporting requirements that represent a challenge for financial markets by requiring significant action from participants.

Quantify the share of your taxonomy-aligned investments

ISS ESG’s EU Taxonomy Alignment Solution enables financial market participants to identify the level of alignment of their investments and financial products with defined taxonomy activities. The solution quantifies respective revenues, capital expenditure, and operational expenditure in order to comply with the upcoming disclosure obligations.

PORTFOLIO REPORTING – KEY FEATURES

A single report at the click of a button, designed to support EU Taxonomy reporting obligations.

Meet Disclosure Obligations

Incorporate directly reported data to meet entity-level reporting requirements under Article 8 of the EU Taxonomy Regulation, as well as modeled data for companies that do not report or are outside the universe for data collection which can be used during the investment decision-making process.

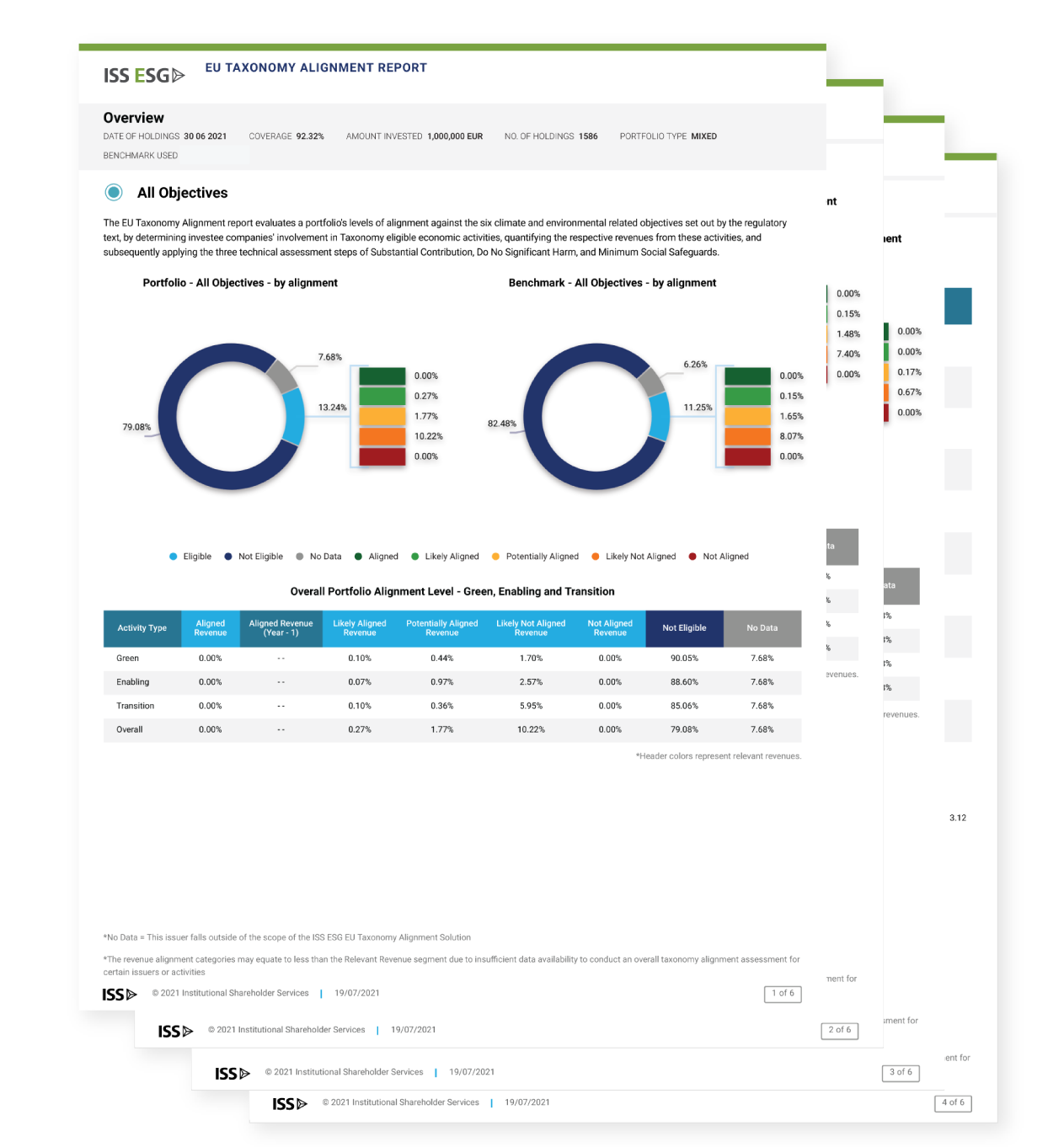

Intuitive Data Visualisation

Easily interpretable charts that can be used for website, pre-contractual and periodic disclosures such as key investor information documents and prospectuses (KIID).

Raw Values For Regulatory Compliance

Data has been included in tabular format to allow the relevant numbers to be easily visible when reporting on regulatory obligations.

Analysis Per Objective, Activity Type And Issuer Type

View overall taxonomy alignment, as well as specific views for climate change mitigation and climate change adaptation, with more to come in 2024 for the remaining objectives. Information on involvement in and alignment with EU Taxonomy eligible activities is provided per Objective (Adaptation, Mitigation), Activity Type (Green, Enabling, Transition, including/excluding Nuclear/Gas) and Issuer Type (including/excluding sovereigns).

AVAILABLE REPORTS:

Identify Your Eligible Taxonomy Activities

ISS ESG’s EU Taxonomy Alignment Solution assists in measuring the degree of alignment of your investments against eligible taxonomy activities, which substantially contribute to one of the Taxonomy objectives and do not significantly harm any of the other taxonomy objectives.

The solution includes all 6 environmental objectives as of November 2023.

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

Analysis of 147 taxonomy-aligned activities including:

- Improved forest management

- Livestock production

- Manufacture of renewable energy technologies

- Manufacture of cement

- Electricity generation from wind power

- Manufacture of aluminium

- Anaerobic digestion of sewage sludge

- Composting of bio-waste

- Freight rail transport

A NFRD indicator flag is also included in order to assist clients with their disclosure obligations.

Rely on our comprehensive & dedicated taxonomy solution.

For companies that do not report: Eligibility coverage of

63,500 issuers

Overall coverage of

8,600 issuers

For companies that directly report Taxonomy data: coverage of approximately

3,600 issuers

to be expanded by end of 2023

Screening based on approx.

1,900 factors

Data as of September 2023. All figures are approximate.

Benefit From Specific Taxonomy Data to Report Alignment

- Customize your reporting and include ‘aligned’ or ‘likely aligned’ capital expenditure and revenues on specific activities and/or assessment steps

- Measure and report on the taxonomy compliance of investment funds

- Report on overall taxonomy alignment at portfolio level

- Engage with investee companies

- Select holdings and design investment products

- Express investment preferences

Leveraging over 30 years of ESG Research & Rating expertise

ISS ESG’s proprietary research and rating methodology has been consistently updated and developed across more than 30 years, aiming to deliver high-quality, material and forward looking ESG data on a company’s sustainability performances.

This methodology is used to support our EU Taxonomy solution, sharing a similar assessment approach for an economic activity’s contribution to sustainable development. Both consider the impacts associated with an activity holistically along the respective value chain and are highly sector-specific.

Trust ISS ESG Taxonomy Solution to help you meet the new EU reporting requirements.