SUSTAINABILITY SOLUTIONS / RATINGS & RANKINGS

Sustainability Bond Rating

Understand the sustainability impact and risks of global labeled debt

Integrate Relevant Sustainability Assessments Into Your Fixed Income Investment Management Process

Our Sustainability Bond Rating provides a relevant assessment of the ESG and climate impact and risk exposure of global labeled debt. It also allows investors to assess how compliant their Green, Social, Sustainability, Transition, and Sustainability-linked fixed income securities are with international standards.

WATCH VIDEO

Access Bond-Level Sustainability Data That Allows You To

Compare the sustainability performance of labeled fixed income securities in your portfolio to identify key sustainability-related drivers of the sustainable bonds market and credit performance.

Facilitate reporting related to labeled fixed income securities across several key markets (e.g., the EU Taxonomy).

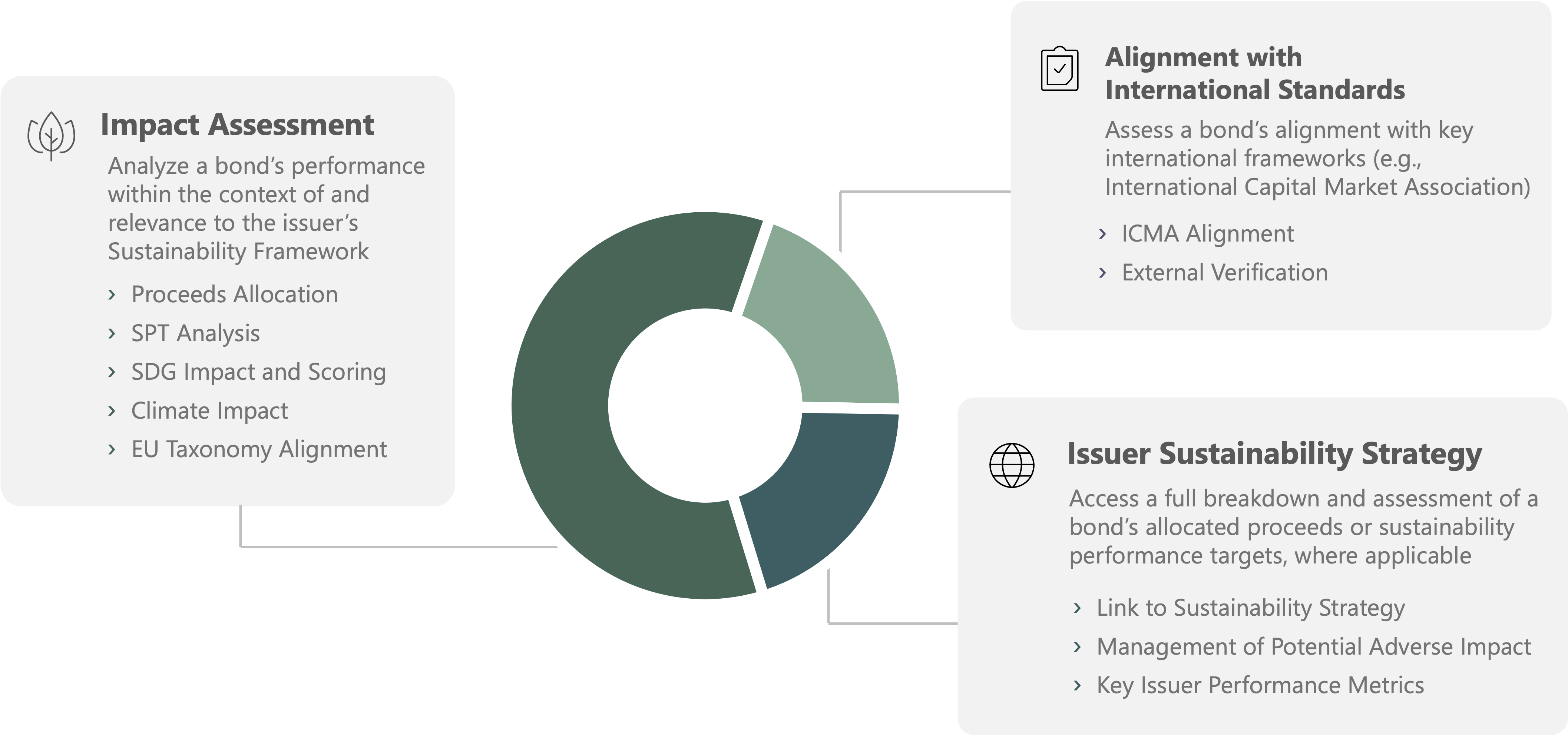

Benefit From a Comprehensive

Rating Methodology

The Sustainability Bond Rating utilizes hundreds of data points to provide an in-depth analysis of the sustainability impact and risks of the financed activity of a bond based on three key pillars.

Coverage includes global corporate, sovereign, and government agency issuances, spanning all regions and industries.

RATING SIGNIFICANCE