ISS ESG / IMPACT & UN SDGS

SDG IMPACT RATING

Conduct a holistic assessment of a company’s impact on the UN SDGs.

Unique Approach to Measuring Impact

Determine a company’s positive or negative impact on the United Nations’ Sustainable Development Goals (SDGs) across three key pillars.

PRODUCTS

& SERVICES

OPERATIONS

MANAGEMENT

CONTROVERSIES

ACCESS IMPACT SCORES ACROSS:

0

SDGs

0

Data factors

0

Issuers

Data as of January 2023. All figures are approximate.

Focus on Materiality

The SDG Impact Rating aggregation model ensures that a company’s overall impact is based on those SDGs in which it, within its sphere of influence, can have the greatest impact.

Highly Industry-Specific Approach

A company’s operations score is based on industry-specific indicators, derived from the ESG Corporate Rating, that are mapped to the relevant SDGs.

Unrivalled Customization

Granular pillar scores can be used to develop custom ratings that align with your unique investment objectives.

Superior Research Quality

Methodology is underpinned by data and insights sourced from four industry-leading solutions within the ISS ESG universe.

SDG Solutions Assessment ›

ESG Corporate Rating ›

Norm-Based Research ›

Controversial Weapons Research ›

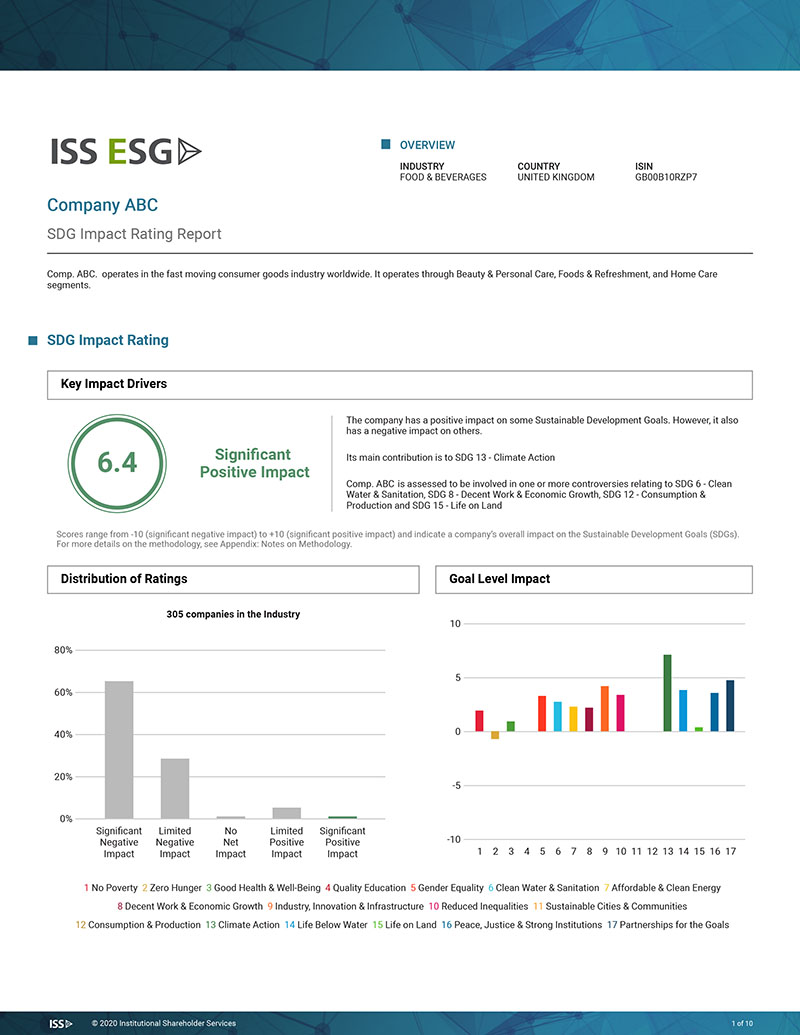

The SDG Impact Rating Issuer Report provides a comprehensive and detailed overview of a company’s overall SDG impact as well as across all 17 SDGs and allows to better understand the issuer’s performance against its industry peers.

KEY BENEFITS

- Concise overview of a company’s overall SDG impact and across all 17 SDGs

- In-depth analysis leveraging 120 data points

- Impact assessment across the pillars Products & Services, Operations, and Controversies

- Additional insight into key impact drivers

- Clear and descriptive infographics

- Industry peers comparison

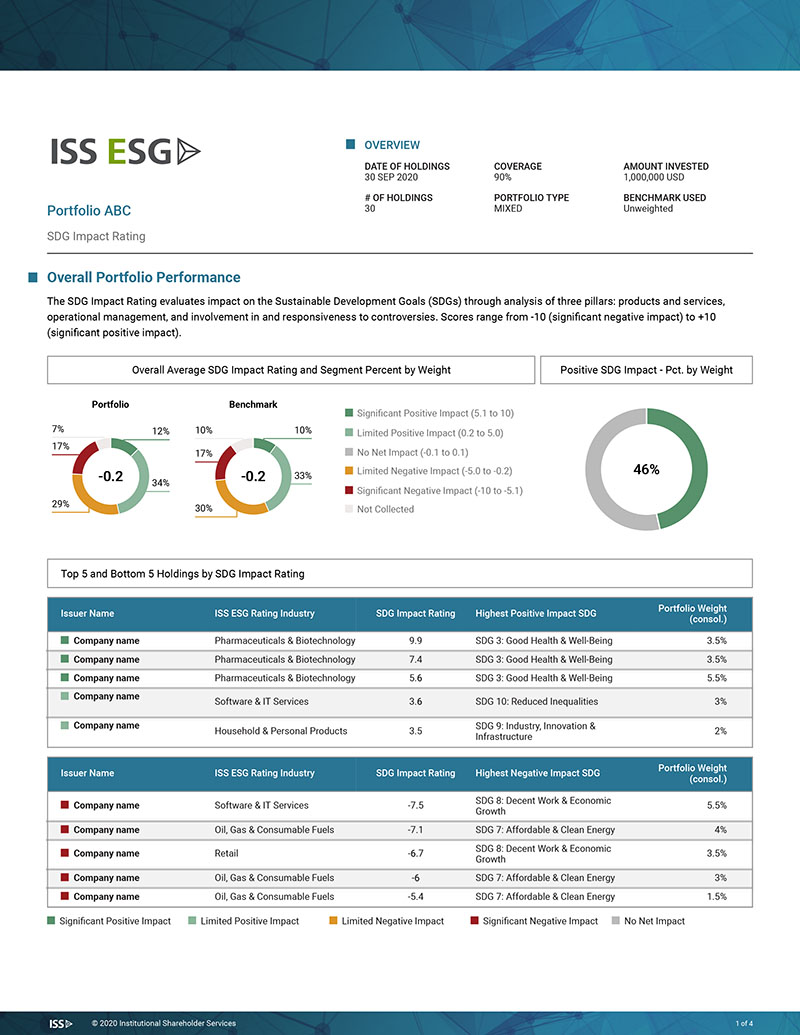

The SDG Impact Rating Portfolio Report offers analyses of a portfolio’s positive and negative impacts on the SDGs, as well as insights into the performance of select holdings in key areas.

KEY BENEFITS

- Overall portfolio SDG impact per impact category by portfolio weight

- Comparison with benchmark of own choice

- Highlight of top 5 and bottom 5 holdings by SDG Impact Rating and weight

- Median portfolio impact for all 17 SDGs, including range of goal ratings

- Highlight of 5 holdings with worst controversy pillar scores by weight