ISS STOXX

Climate and Nature

Wider coverage, greater insight and comprehensive solutions,

making us the natural choice.

Jump To: Data | Voting | Index | Engagement | Reporting

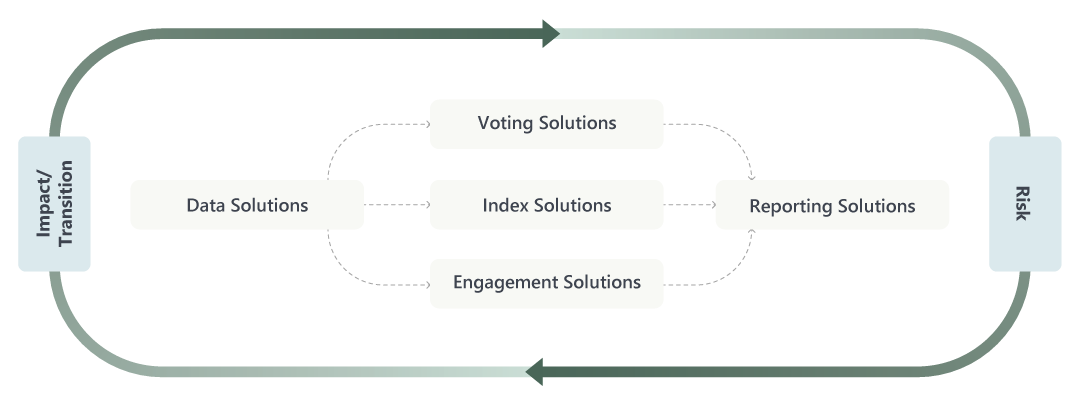

Services designed to supporting core investment functions, assisting with risk management and enabling more informed decisions across the investment lifecycle.

Data Solutions

Our Climate and Nature Data Solutions allow access to high quality, granular data sets to meet regulatory and client requirements.

The solutions include a suite of climate analytics to monitor and mitigate climate-related impact, assess temperature scenarios at both the issuer and portfolio level, understand the impact of physical and transitional climate risks and assess nature-related risks such as biodiversity loss and deforestation.

Specific data solutions include:

- Climate Impact Dataset

- Scenario Analysis

- Carbon Emissions Data

- Potentially Avoided Emissions Data

- Physical Risk, Transition Risk

- Carbon Risk Rating

- Sovereign data

- Biodiversity Impact Assessment

- SDG Alignment (14,15)

- Industry Average Emission Intensities

- Deforestation (Palm Oil)

- ESG Ratings

- Water Risk Rating

- Net Zero Solution

Voting Solutions

Our Climate and Nature Voting Solutions align voting strategies with environmental risks, stewardship priorities, and client mandates. By leveraging proprietary research, in-house climate and nature data, and governance experience, these solutions provide a comprehensive approach to enhanced climate and nature-focused perspectives for proxy voting. This includes structured policies for informed execution, customized voting strategies, and advanced insights on net zero and biodiversity.

Strategic Benefits:

- Manage Environmental Risks: Make informed proxy voting decisions with enhanced recognition of climate and nature-related risks.

- Align with Strategic Objectives: Tailor voting strategies to reflect your organization’s unique perspectives and fiduciary responsibilities.

- Streamline Voting Processes: Efficient and scalable vote execution, and reporting, through integration with our ProxyExchange platform.

This robust framework supports informed, consistent, and credible voting decisions, backed by high-quality data and proprietary research.

Our solutions include:

- Specialty Climate Voting Policy

- Custom Climate Voting Policy

- Sustainability Policy Net Zero

- Biodiversity in Custom Research

Index Solutions

Indices may represent the most efficient vehicle to implement climate strategies, whilst bringing additional cost and disclosure benefits. Index inputs including forward-looking carbon metrics, varying climate scenarios, biodiversity impact and net zero alignment are fundamental to build modern, low-carbon portfolios.

Climate and Biodiversity Indices

Our range of climate indices helps reduce exposure to climate-related financial risks and increase allocations to companies offering opportunities in the transition to a low-carbon economy. Our biodiversity indices provide a comprehensive framework to address our world’s nature-related challenge.

Climate Indices

Our climate indices are designed to facilitate the shift towards a low-carbon economy and align investments with the Paris Agreement, EU Climate Benchmarks regulation, and other decarbonization objectives.

Biodiversity Indices

Our biodiversity indices provide a framework to help address nature-related challenges. Stock selection is based on exclusionary screens, Sustainable Development Goals (SDGs) and carbon emissions targets.

Engagement Solutions

Our Engagement Solution allows participation in a joint outreach and dialogue with companies on material sustainability-related themes. By engaging collaboratively, it is possible to leverage scale in discussions on sustainability issues and communicate concerns to corporate management more effectively. ISS STOXX facilitates engagement on behalf of participating clients to promote positive change through active ownership and dialogue. This may include ongoing dialogue with targeted companies for enhanced disclosure, a push for improved sustainability performance, or the mitigation of Sustainability risks.

ISS STOXX’s experience enables the measurement of progress over the engagement

lifecycle, to evaluate engagement success and to track and report the status of engagements on a quarterly and annual basis.

lifecycle, to evaluate engagement success and to track and report the status of engagements on a quarterly and annual basis.

The Thematic Engagement Solution covers four themes and leverages ISS STOXX’s proprietary products and datasets:

- Biodiversity

- Net Zero

- Norm-Based Research

- Water

Reporting Solutions

Specialized climate and nature-related datasets and analytics that help navigate and comply with increasing disclosure requirements.

- Climate Impact Report

- SDG Report

- Biodiversity Impact Assessment Tool

- Carbon Footprint Report

- EBA Pillar 3 Solution