SUSTAINABILITY SOLUTIONS / RATINGS & RANKINGS

ESG Country Rating

Comprehensive research and data to identify sustainability risks

and seize investment opportunities.

ESG Country Ratings are an ideal complement to conventional financial ratings. They provide detailed analyses of the sustainability performance and risks of all EU, OECD and BRICS countries as well as other important sovereign issuers from Asia and South America.

APPROX.

100%

COVERAGE OF GLOBAL SOVEREIGN DEBT ISSUED

ESG Country Ratings are an important indicator of a country’s economic potential and stability.

Environmental and social dimensions allow investors to draw well-informed conclusions about a state’s long-term stability.

Our analysts gather information from the media and other public sources. They conduct interviews with stakeholders, and collect information on country policies and legislatives. Exchange with various NGOs and a strict verification ensure objectivity and depth of the country research.

ESG COUNTRY RATINGS MAKE A DECISIVE

CONTRIBUTION TO REDUCING INVESTMENT RISKS

Investors are enabled to make a sound assessment of the long-term solvency of government bond issuers.

PRIME STATUS

Awarded to countries that rank among the world´s best countries in terms of sustainability performance.

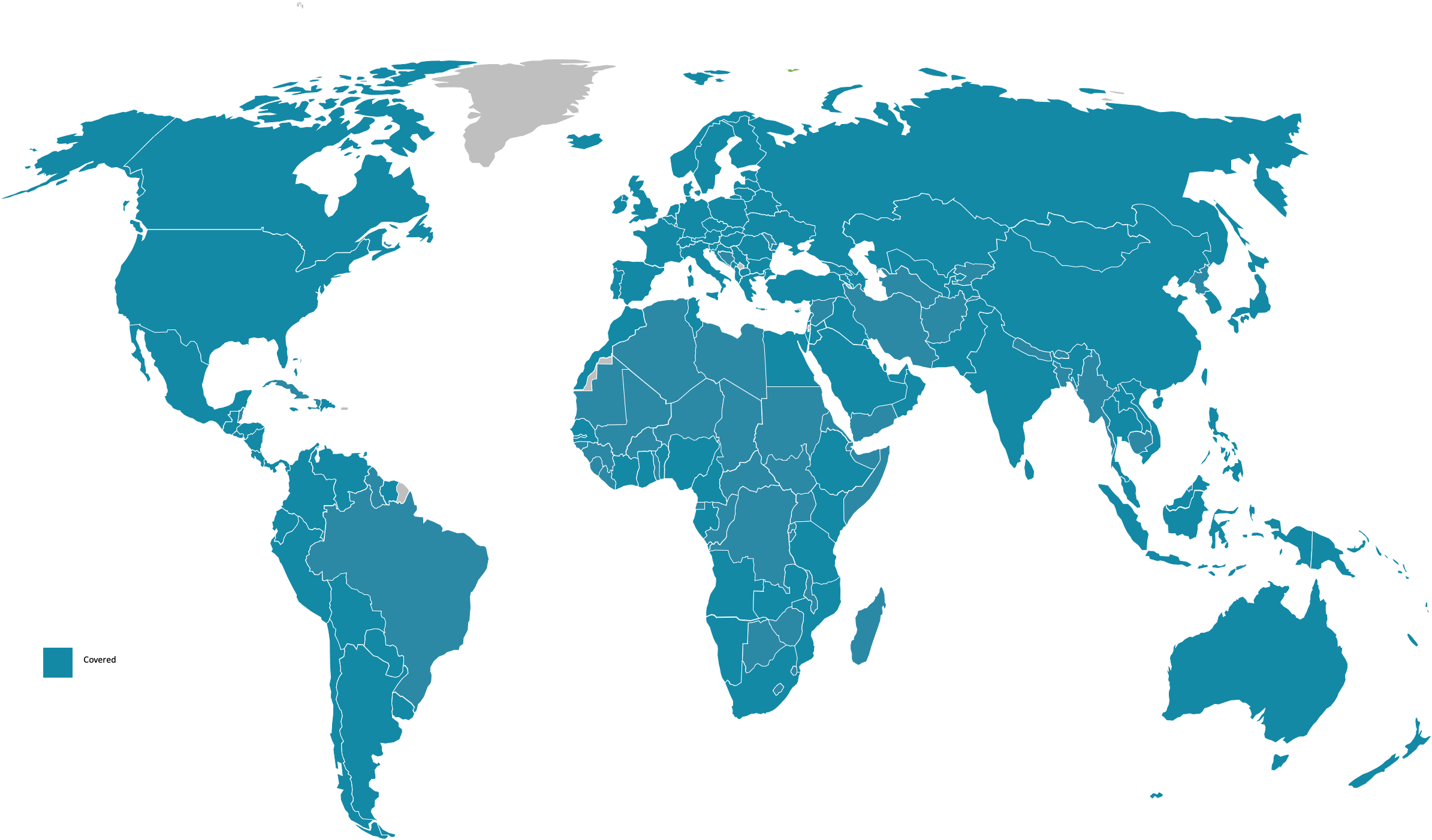

COVERAGE

Our ESG Country Ratings universe contains the world’s largest issuers of government bonds.

The ratings are based on the analysis of some 100 social and environmental criteria.