Following approval of the Shareholder Rights Directive modified text by the European Council in April, there has been much discussion around the practicality of implementation for some of the more ‘voting mechanics’ related articles in the Directive, specifically those contained in chapter 1a; Identification of Shareholders, Transmission of Information and Facilitation of Shareholder Rights.

Chapter 1a builds on the changes implemented in the first Directive and seeks to further strengthen the rights of both investors and Issuers. As a result, it places a potential burden on the chain of intermediaries that sits between these parties. Through each of the articles in chapter 1a, Investors should be able to enjoy fair and transparent pricing, timely access to all meeting related data, greater transparency of the process and a simpler process for engaging with the Issuer. Issuers should also benefit from more timely voting information and the ability to identify who is voting their shares which will aid engagement. That said, there remains the complexity of different voting requirements across markets and the complexity of the intermediary chain between investor and issuer.

The last few years has also seen increased focus on new ‘technology’ and its potential to disrupt the current state of play in many industries where inefficiencies and a lack of transparency are present. At the end of June, the European Commission (EC) organized a conference to discuss the SRD against the backdrop of this emerging technology: EU Corporate Governance in the 21st Century – Shareholder Rights Directive and Beyond.

One of the panel discussions brought together six experts representing each facet of the corporate governance process: institutional investors’operational challenges (ISS), retail investors (DSW), custodians and intermediaries (Corporance), central securities depositaries (Nasdaq Estonia), issuers / registration (Munich Re) and issuers / company law (Sonepar). The panel discussed how modern and emerging technology could help the corporate governance process. The panelists from Corporance and Nasdaq Estonia presented some recent blockchain related voting pilots and projects in Spain and Estonia respectively, highlighting what could potentially be achieved. The panelist from DSW highlighted a recent example of a retail investor in France being prevented from exercising their vote for a German Issuer. The Panelist from Sonepar explained how new technologies could help make the documentation process for the Board of Directors far more efficient than it is today.

A key message, however, was that while the new and emerging technology shows promise and the potential to help find solutions to existing barriers, caution should be exercised to ensure new challenges (for example a divergence of standards caused by multiple competing solutions) are not inadvertently introduced.

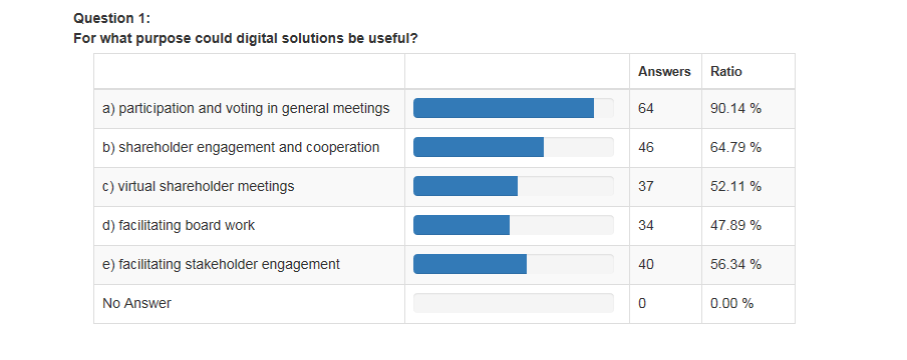

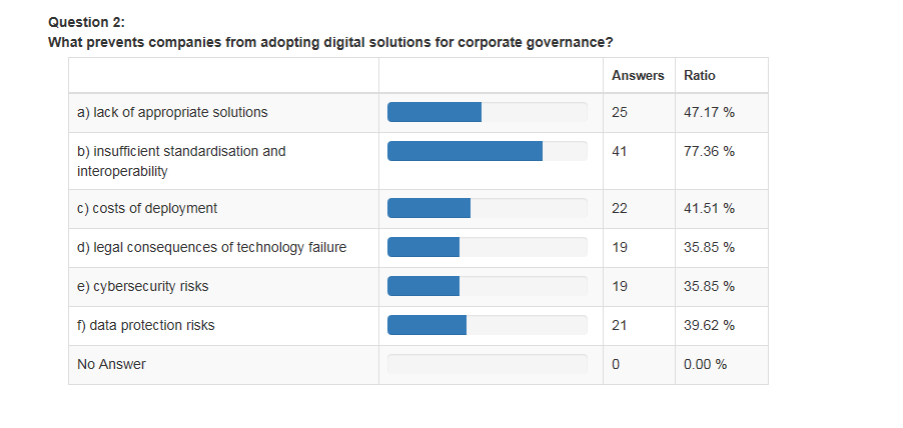

Two interesting polls were also conducted during this session of the conference to ascertain from the audience where solutions should best be targeted and what prevents adoption of new technology.

The results clearly indicate the continued need to address the voting chain and also to ensure that standardization and interoperability remain a key focus to ensure adoption. These poll results underline the message from the panel session that the current race to build blockchain based solutions must not introduce new challenges as a result of a multiplicity of platforms that are market or intermediary specific.

Discuss the issues raised in this article and find out how ISS can help.

About This Article

The ISS Intermediary Solutions team provides regular updates on new regulatory and market developments to help you develop your products and differentiate your offering. Our latest update looks at the EU Shareholder Rights Directive implementation debate regarding new technology and corporate governance.

Discuss the issues raised in this article and find out how ISS can help.