SUSTAINABILITY SOLUTIONS / RATINGS & RANKINGS

ESG Corporate Rating

Assess sustainability risks in your portfolio with data-driven & analyst-led ratings

Evaluate companies’ sustainability-related risks, opportunities, and impact along the corporate value chain.

The ratings are supported by a global team of in-house experts led by a team of sector heads with significant capital markets experience, who bring further depth of sectoral expertise to the team.

ACCESS HIGHLY RELEVANT, MATERIAL, AND FORWARD-LOOKING RATINGS

Enhance your security

selection process

Develop investible

products

Inform your proxy voting

decisions

Identify companies for

engagement

Report on portfolio ESG metrics

with a high degree of transparency

ESG CORPORATE RATING

Transparent Methodology

At ISS STOXX, we firmly believe in the value of transparency as a catalyst for selecting the sustainability solutions best suited to realizing sustainable investment objectives. As such, we are making our comprehensive Methodology and Research Process Document, an overview of the approach to evaluating the performance of companies through the ESG Corporate Rating, as well as the results of our latest ESG Corporate Rating Survey publicly available.

The methodology document provides detailed information on our approach to evaluating the sustainability performance of companies, and supports investor clients’ reporting needs in specific jurisdictions, as well as fulfilling stakeholder expectations with regard to (public) methodology transparency. In addition to exploring fundamental questions such as methodological foundations and materiality, the document comprehensively covers the rating methodology and process, including:

- Industry Classification

- Rating Structure, Weightings, and Key Issues

- Assessment Rules

- Rating Outputs and Signals

- Rating Process

- Quality Assurance

ESG RAW DATA

Customize your investment strategies with qualitative and quantitative data

Sustainable investing is not one-size-fits-all, and diverse strategies require diverse solutions. ESG Raw Data offers a comprehensive set of environmental, social, and governance datapoints with no additional assessment or scoring overlay, enabling you to extract and act on the insights most relevant to you. Customize your investment strategies to better align with your goals.

IFRS Sustainability Alliance Member

As a IFRS Alliance Member, we aim to educate asset owners and asset managers on the importance of materiality and the inclusion of performance information for successful sustainable investing integration.

Holistic Approach to Assessing Sustainability Through a Double-materiality Lens

Building on extensive experience and expertise

in the field of sustainability

We have developed a holistic and

forward-looking concept of materiality

that focuses on long-term value creation.

Our performance analysis assesses risks and impacts related to all relevant stakeholders such as:

EMPLOYEES

SUPPLIERS

CUSTOMERS

COMMUNITIES

ECOSYSTEMS

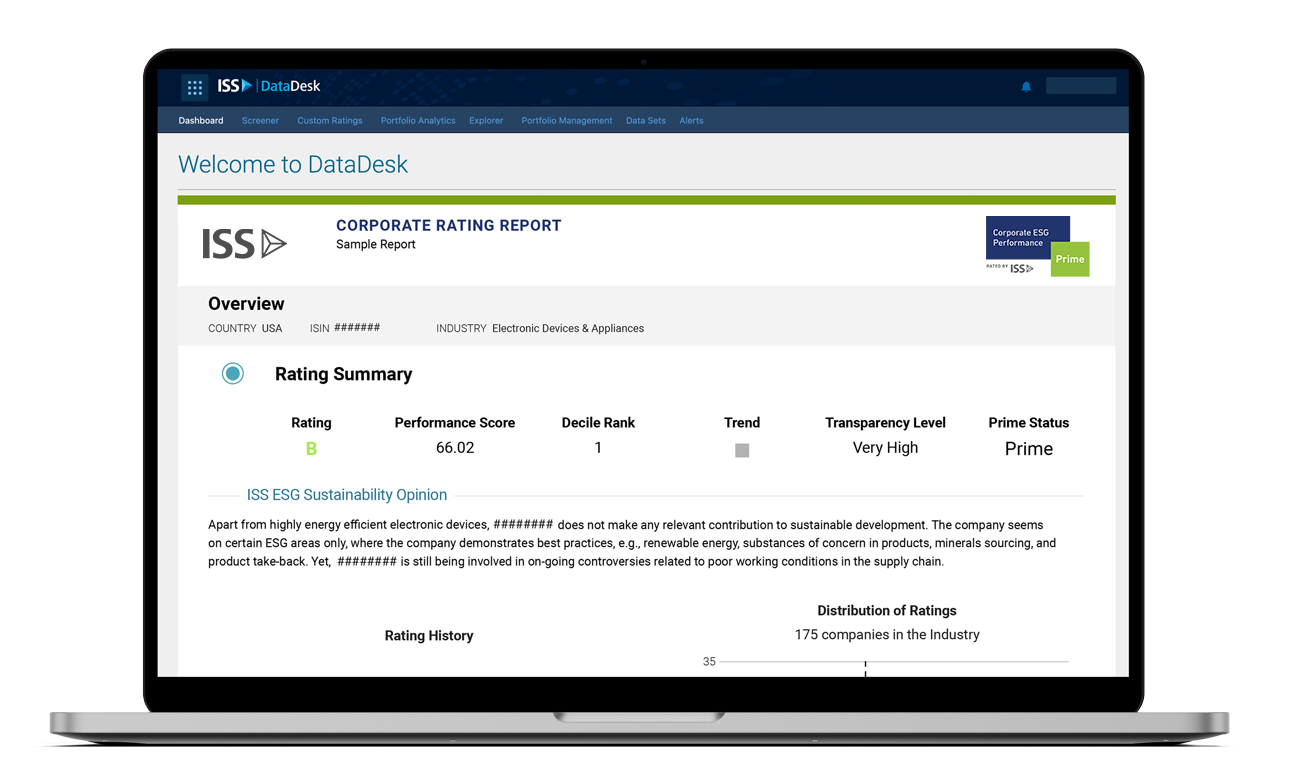

PRIME STATUS

Awarded to companies with an ESG performance above the sector-specific Prime threshold, which means that they fulfil ambitious absolute performance requirements.

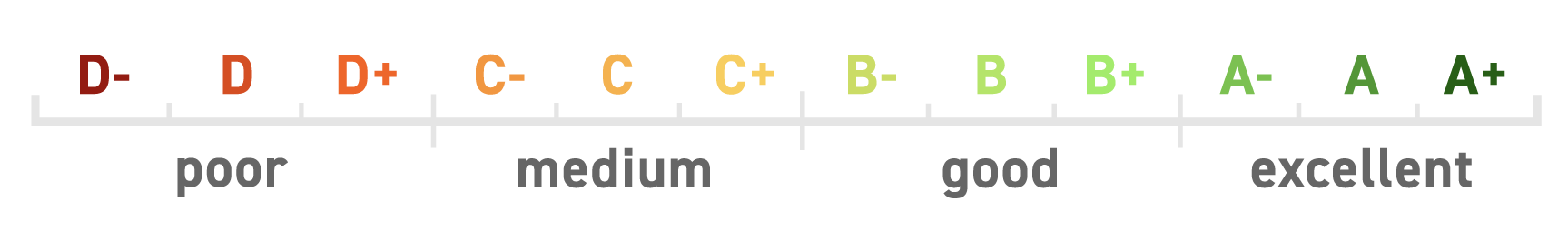

ESG CORPORATE RATING PERFORMANCE SCALE

Companies are rated, from D- to A+, on their sustainability performance on an absolute best-in-class basis.

Introducing the Financial and ESGF (ESG + Financial) Ratings

The Financial Rating is a standalone rating that can be used on its own to assess companies’ financial performance. The ESGF Rating combines the Financial Rating and ESG Rating to provide a holistic assessment of companies’ performance. Both ratings and the underlying data factors leverage data from ISS EVA, an established standard in measuring, analyzing, projecting, valuing, and discounting a firm’s underlying economic profit rather than its accounting profit.

High-level and detailed company reports are available for download on our proprietary DataDesk platform. Recent enhancements to the reports include:

- New design that presents key outputs and signals in an easily digestible manner

- Further insights related to Key Issues (Key Issue detail, Key Issue materiality graph)

- Introduction of new financial (EVA Margin), SDG-, and climate-related scores and metrics

- Additional rating performance summary pages

- Integration of a year-on-year trend factor at the indicator level

THE SUSTAINABILITY DIFFERENCE

Absolute performance assessments, beyond

‘best-in-class’

Transparent disclosure of all indicator scores and weights

Industry- and company-specific approach to assessing material risks and opportunities

Systematic consideration of the impact of companies’ products and services on the UN SDGs

Alignment with market expectations and regulatory frameworks on materiality

Continuous issuer dialogue and feedback are key components of the quality assurance process

Methodology is guided by established international guidelines, such as the

- UN Global Compact

- UN Sustainable Development Goals

- International Labour Organization

- OECD Guidelines for Multinational Enterprises

- UN Principles for Responsible Investment

- EU Sustainable Finance Regulation