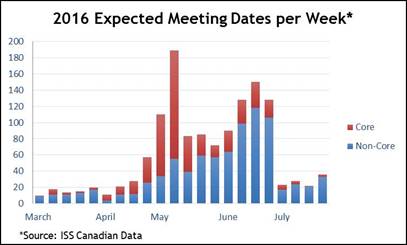

Canadian proxy season typically has two significant meeting date peaks, in May and June. The meetings tend to shift in mid- to late-May from widely-held TSX companies to much less widely-held smaller TSX and Venture-listed issuers. Based on ISS data covering meetings from last year, and those already scheduled for this year, the highest volume appears to fall on May 5-11 for the first peak and June 23-27 for the second peak.

What to Look for in 2016

New Regulatory Certainty for Takeover Bids

On Thursday Feb. 25, 2016, the Canadian Securities Administrators released new take-over bid rules intended to facilitate the ability of shareholders to make informed and coordinated tender decisions, and to provide an offeree board with additional time and discretion when responding to a takeover bid. Assuming all necessary ministerial approvals are obtained, the new rule will come into force on May 9, 2016.

Specifically, the amendments to MI 62-104 and NP 62-203 will require the following for all non-exempt take-over bids:

- Tenders of more than 50 percent of the outstanding securities of the class that are subject to the bid, excluding securities beneficially owned, or over which control or direction is exercised, by the offeror and joint actors (the Minimum Tender Requirement);

- The extension of a take-over bid by the offeror for an additional 10 days after the Minimum Tender Requirement has been achieved, and all terms and conditions of the bid have been complied with or waived (the 10 Day Extension Requirement);

- That the take-over bid remain open for a minimum deposit period of 105 days, unless:

- the offeree board states in a news release a shorter deposit period of not less than 35 days, which shorter minimum bid period will also apply to all contemporaneous takeover bids, or

- a news release is issued by the offeree company indicating that it intends to effect an alternative transaction, in which case all contemporaneous takeover bids will be subject to the shorter minimum bid period of 35 days.

Given that the new rules come into force in the middle of proxy season, ISS is not contemplating any immediate update to its Canadian Shareholder Rights Plan voting policies. ISS will continue to rely substantially on its current guidelines to ensure inappropriate board discretion or language does not creep into shareholder rights plans that may, for example, support the proliferation of “voting pills.” The one exception will be the 105-day minimum bid period, which should be the maximum supported.

The Return of Option Exchanges

In the Canadian market, repricing of outstanding stock options is seen as taboo by the investor community. Historically, very few companies have attempted stock option exchange proposals. The last such proposals reviewed by ISS occurred in the wake of the 2008-2009 financial crisis.

Market pundits have determined that the Canadian market is now in “bear” territory, following a longer than anticipated commodities bear market. The pain in the energy and materials sectors, notwithstanding a rally in gold, is increasing the likelihood that Canadian investors may be faced with more option repricing proposals and the return of option exchange programs. Other industry groups may also try option exchanges given the extended reach of the economic downturn.

Exchange programs take different forms: option for option, option for stock, or option for cash. Any company proposing an exchange program must structure the proposal to, ideally, benefit shareholders as well as the option holder participants, and must also provide extensive rationale as to why shareholders should support such a proposal. Even then, stock options are not favoured by Canadian institutional investors as a form of incentive compensation, and companies may have an uphill battle winning support for exchange programs.

The recent indication that the Liberal Government has tabled its proposal to change the tax rules for stock options may result in this type of incentive remaining widely used by Canadian companies for senior executives in the current market environment. Whatever the case, there are a large number of Canadian companies with underwater stock options at present, so shareholders should be prepared to deal with repricing and exchange proposals during the 2016 proxy season.

Gender Diversity

New gender diversity disclosure rules came into effect for non-venture companies last year, per amendments to NI 58-101 Disclosure of Corporate Governance Practices.

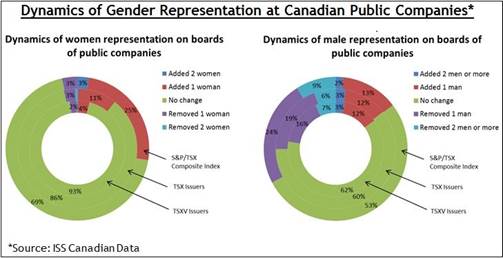

This event-study examines how Canadian issuers responded to the implementation of the disclosure requirements by looking at boards’ gender dynamics during the last year. All figures are based on a sample of public companies that held annual meetings in each of 2014 and 2015, and were reviewed by ISS.

The graph tracks changes in gender composition for each issuer in the sample. Resulting data shows that a significant percentage of issuers have added at least one woman to their boards during the course of the last year: 27.6 percent and 10.8 percent of TSX Composite issuers and TSX-listed issuers (excluding Composite Index issuers), respectively.

A comparison of male to female board composition yields some interesting observations. While the percentage of boards increasing the number of female directors significantly exceeded the percentage of boards removing female directors, the opposite was true for male directors. This finding may be an indication that the new disclosure requirements are a driving force behind greater female board representation.

In contrast to TSX-listed issuers, only a small percentage of TSXV-listed companies (about 4.2 percent) altered their board composition to add one or more woman. Compared to TSX-listed issuers, Venture issuers are less likely to make board changes year-over-year. –ISS Canadian Research Team

The foregoing is taken from ISS’ 2016 Canada Proxy Season Preview. For the full report, Governance Exchange members may go here.